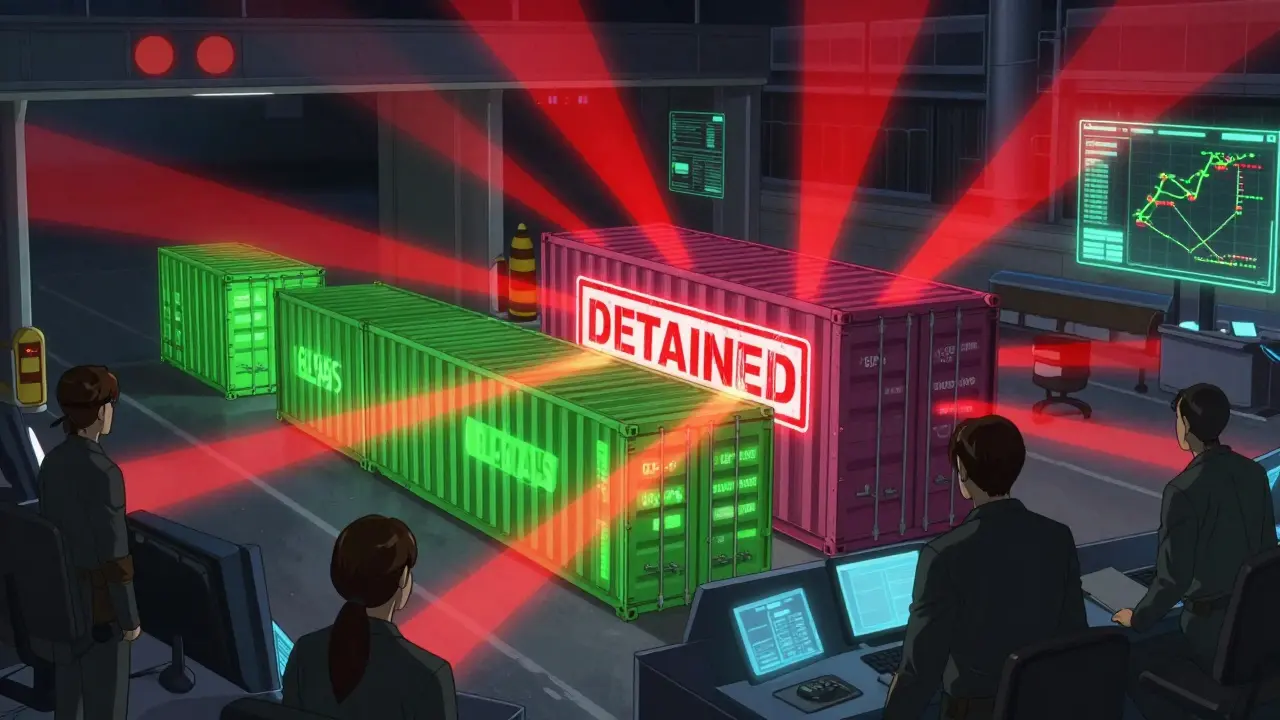

The U.S. Food and Drug Administration (FDA) doesn’t wait for a single bad batch of medicine to hit pharmacy shelves before acting. Instead, it uses a powerful tool called an Import Alert to stop entire lines of drugs from entering the country - even before they arrive at the border. If your drug manufacturer isn’t on the FDA’s approved list, your shipment gets automatically detained. No inspection. No warning. Just blocked.

What Is an FDA Import Alert?

An FDA Import Alert is a public notice that flags specific manufacturers, facilities, or countries as high-risk for producing substandard or illegal drugs. Once a facility lands on an alert, every future shipment from that source is held at U.S. ports of entry without needing physical testing. This is called Detention Without Physical Examination (DWPE). It’s not a punishment for one mistake - it’s a response to repeated failures. The system started in 1995 but got a major upgrade in 2023 with the PREDICT program, which uses over 150 data points to predict risk. These include past inspection results, refusal rates, supplier history, and even the type of drug being imported. High-risk products like injectables, biologics, and active pharmaceutical ingredients (APIs) are targeted first because a single faulty batch can hurt or kill patients.The Green List: A New Era of Enforcement

In September 2025, the FDA rolled out its most aggressive move yet: the Green List for GLP-1 receptor agonist APIs. This includes semaglutide, tirzepatide, liraglutide, and other weight-loss and diabetes drugs that exploded in popularity after 2020. The agency didn’t just ban imports - it created a whitelist. Manufacturers on the Green List get fast clearance. Their shipments skip detention entirely. But if you’re not on it? Your drugs get stopped. As of October 2025, 98.7% of non-Green List GLP-1 API shipments were refused. That’s not a glitch. It’s policy. Why? Because the FDA found alarming levels of contamination. A September 2025 study showed 68.4% of refused shipments had impurities exceeding international safety limits. Some had incorrect dosing, others had unapproved additives. In one case, a batch meant for diabetes treatment contained a toxic solvent used in industrial cleaning.Who Gets Blocked - And Why?

The majority of blocked manufacturers are in India. Of the 89 facilities affected by the GLP-1 Import Alert, 73 (82%) are based there. China accounts for 10%, Europe for 8%. But it’s not about geography - it’s about compliance. Many Indian and Chinese factories produce APIs cheaply and at scale. They meet local standards but not FDA’s. Their documentation is incomplete. Their quality control is patchy. Their auditors aren’t FDA-recognized. One manufacturer on Reddit reported losing $1.2 million in 72 hours because their ISO 9001 certification didn’t count - only FDA-approved audits do. Even if your drug is chemically pure, if you can’t prove how you made it, where your raw materials came from, or how you tested each batch, it gets rejected. The FDA doesn’t just want safe drugs. They want verifiable, traceable, documented safety.

What Happens When a Shipment Gets Blocked?

Once a shipment is detained, you have 90 days to decide: export it or destroy it. No exceptions. No delays. And if you try to sneak it in? Penalties can hit up to three times the value of the goods. For a $900,000 shipment, that’s $2.7 million in fines. Some companies are paying brokers to falsify export paperwork just to avoid the loss. The FDA caught one Singapore-based intermediary doing this and issued a warning letter in October 2025. Others are quietly destroying shipments and claiming they were “lost in transit.” The FDA is watching for these patterns too.How to Get on the Green List

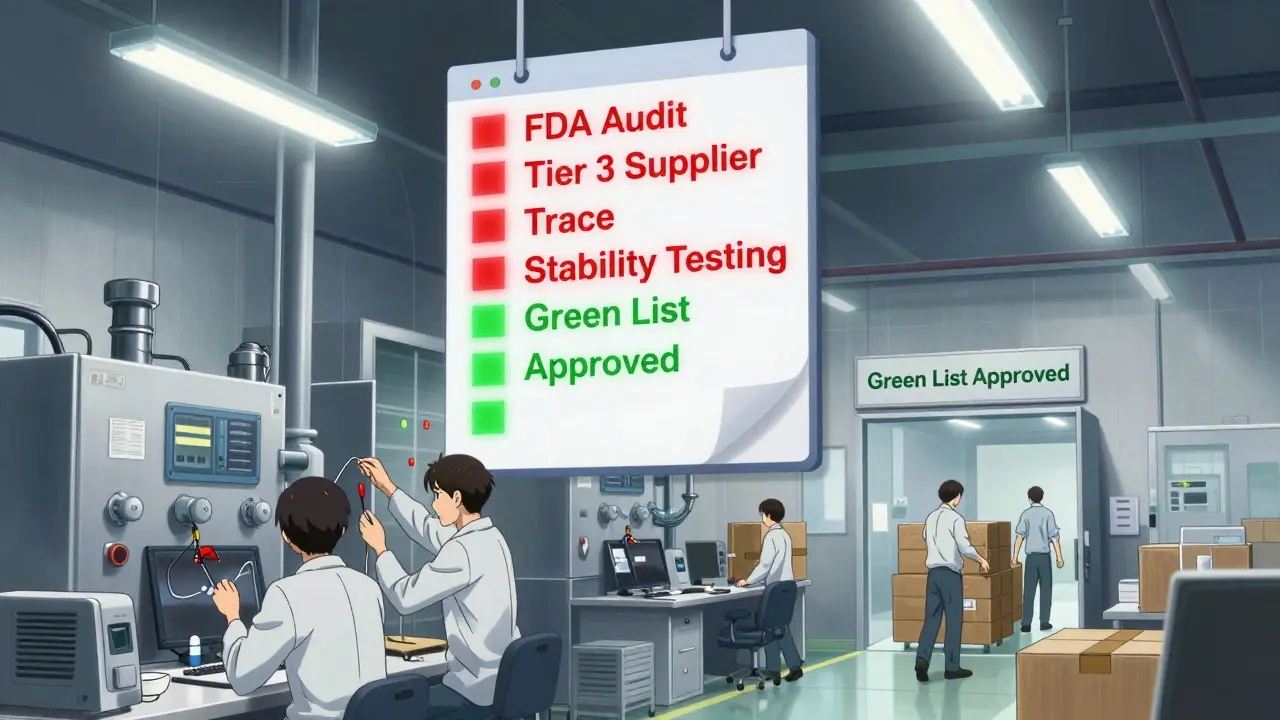

Getting on the Green List isn’t easy. It takes 137±28 hours of work - and $45,000 to $68,000 in audit fees alone. You need:- A third-party audit by an FDA-recognized auditor

- Stability testing across three temperature conditions (2-8°C, 25°C/60% RH, 40°C/75% RH)

- Full supply chain mapping - including Tier 3 suppliers (raw material sources)

- Three consecutive compliant shipments verified by the FDA

- Executive certification that your facility meets all current GMP standards

The Ripple Effect: Prices, Jobs, and Global Shifts

The GLP-1 import ban has already reshaped the market. Between September and October 2025, API imports from non-Green List manufacturers dropped 92.4%. The global GLP-1 market, worth $35.2 billion in 2024, is now dominated by a few approved suppliers. Prices for compounded GLP-1 formulations rose 14.3% in November 2025. U.S. pharmacies are scrambling to find alternatives. Generic makers like Viatris reported a $417 million revenue hit in Q3 2025. In India, 28,500 jobs are at risk across 47 facilities. The Indian Pharmaceutical Alliance says the ban could shutter dozens of factories. Meanwhile, global CMOs like Catalent are buying up peptide production lines - their October 2025 acquisition of Novasep’s business was directly tied to the new import rules.

What’s Next?

The FDA isn’t stopping with GLP-1 drugs. In November 2025, Commissioner Dr. Robert Califf said the same import alert framework will expand to all high-risk biologics - starting with monoclonal antibodies in Q1 2026. That means cancer drugs, autoimmune treatments, and gene therapies could face the same scrutiny. China’s NMPA announced it will require all API exporters to meet FDA-equivalent standards starting January 1, 2026. The European Medicines Agency is following suit, planning similar API screening by mid-2026. The message is clear: if you want to sell drugs in the U.S., you must play by FDA rules - no shortcuts, no exceptions.What If You’re Already Blocked?

If your facility is on a Yellow or Red List, don’t panic - but don’t delay either. The average time to get off an Import Alert is 11.7 months. Some take over two years. Successful removal requires:- A full FDA inspection (minimum 5 days on-site)

- A root cause analysis with a detailed Corrective and Preventive Action (CAPA) plan

- Three consecutive compliant shipments

- Video evidence of your fixes - document-only submissions have a 42% rejection rate

Final Thoughts

The FDA’s Import Alert system isn’t perfect. Critics say it creates artificial shortages and pushes patients toward unregulated gray markets. But the data speaks: contaminated drugs are being kept out. Patients are safer. The system works - but it’s expensive, slow, and unforgiving. For manufacturers, the lesson is simple: compliance isn’t optional. If you’re producing APIs for the U.S. market, you need to invest in real quality systems - not just certifications on paper. The Green List isn’t a reward. It’s the new baseline.What happens if my drug shipment is detained under an FDA Import Alert?

Your shipment is held at the U.S. port of entry and cannot enter the country. You have 90 days to either export the goods back to the country of origin or destroy them under FDA and Customs supervision. Failure to act within this window can result in fines, seizure of goods, and penalties up to three times the commercial value of the shipment.

Can a manufacturer get removed from an FDA Import Alert?

Yes, but it’s difficult. Manufacturers must complete a full FDA inspection, submit a detailed Corrective and Preventive Action (CAPA) plan, prove three consecutive compliant shipments, and provide executive certification. Video evidence of improvements increases approval chances from 42% to 87%. The average time to removal is nearly 12 months.

Why are so many Indian manufacturers affected by the GLP-1 Import Alert?

India produces over 70% of the world’s generic APIs, including many for GLP-1 drugs. While many facilities meet local standards, they often lack FDA-compliant documentation, third-party audits, or supply chain traceability. The September 2025 GLP-1 Import Alert specifically targeted facilities with repeated violations - 73 of the 89 affected were in India, compared to just 9 in China and 7 in Europe.

What is the Green List, and how do I get on it?

The Green List is a whitelist of API manufacturers approved by the FDA to ship GLP-1 drugs without detention. To get on it, you need an FDA-recognized third-party audit, stability testing under three conditions, full supply chain mapping to Tier 3 suppliers, and three consecutive compliant shipments. The process takes 137+ hours and costs $45,000-$68,000 in audit fees alone.

Are other countries adopting similar import rules?

Yes. China’s NMPA will require all API exporters to meet FDA-equivalent standards starting January 1, 2026. The European Medicines Agency plans to implement similar API screening protocols by mid-2026. The U.S. system is becoming the global benchmark for drug import safety.

Will this affect my prescription medications?

If your medication is a brand-name drug made by an FDA-approved U.S. or EU manufacturer, you’re unlikely to be affected. But if you use generic or compounded versions - especially GLP-1 drugs like semaglutide or tirzepatide - prices may rise due to reduced supply. Some pharmacies may switch to approved suppliers, which could change the brand or form you receive.

What’s the future of FDA Import Alerts?

The FDA plans to expand the GLP-1 Import Alert model to all high-risk biologics, starting with monoclonal antibodies in Q1 2026. This means cancer treatments, autoimmune drugs, and gene therapies will face the same strict screening. By 2027, an estimated 65-75% of global API manufacturers will need to spend $500,000 to $2 million to comply - or lose access to the U.S. market entirely.

Comments

They're using 'safety' as an excuse to crush Indian pharma so Big Pharma can raise prices again. You think this is about patients? Nah. It's about control. They don't want cheap generics. They want you hooked on $10k/month drugs. Watch how fast the Green List gets filled with American subsidiaries of the same Indian companies. The game never changes.

Good. Let the foreigners figure out how to make medicine right. We don't need their sloppy labs poisoning our kids. If you can't meet American standards, go sell your crap somewhere else. This isn't charity. It's sovereignty. And the FDA is finally acting like it.

So let me get this straight - you're telling me the FDA is now the VIP bouncer for GLP-1 drugs? 🤡 Green List = VIP section. Everyone else gets tossed into the alley with their $900k shipment. At least they're not letting in batches with industrial cleaner in them. 😅 Still... $68k just to prove you didn't cook your API in a bathtub? Yikes.

You know what’s ironic? The same people screaming about corporate greed are now demanding we ban foreign manufacturers because they’re ‘cheap.’ But cheap doesn’t mean unsafe - it means accessible. And now the FDA has turned drug manufacturing into a luxury subscription service. Who’s really benefiting here? Not the patient. Not the worker. Just the shareholders in the approved labs.

Let’s be real - if you’re running a facility that can’t pass a 5-day FDA inspection after 30 years of making APIs, you shouldn’t be making medicine at all. This isn’t discrimination. It’s due diligence. People die from bad drugs. Not ‘maybe’ die. Die. And you want to let some guy in Bangalore slap a fake GMP sticker on a bottle because it’s cheaper? That’s not capitalism. That’s manslaughter with a spreadsheet.

I get why the FDA is doing this. I really do. But I also feel for the workers in India who are losing jobs because of a system that doesn’t give them a fair shot. Maybe instead of just blocking everything, we could fund training programs, send inspectors to help them upgrade, not just punish. Safety and compassion aren’t opposites - they should go hand in hand.

Blocked shipments? Good. Let them rot.

I just... I don’t know how to feel about this. 🥺 On one hand, I’m terrified of someone getting poisoned by a fake semaglutide batch. On the other, I know people who can’t afford their meds now because prices jumped 14%. And I know families in India who are losing everything. It’s not black and white. It’s like watching a train wreck and knowing you could’ve stopped it - but you didn’t know how. I just wish there was a bridge, not a wall.

You think this is about safety? Please. This is about power. The FDA doesn’t care if you’re clean - they care if you’re compliant. And compliance means paying them, their contractors, their auditors, their consultants. The Green List isn’t a whitelist. It’s a paywall. And the people who can’t afford it? They’re not ‘non-compliant.’ They’re just poor. And in this system, poverty is a crime.

The CAPA documentation requirements are grossly under-resourced for SMEs. The 3-consecutive-shipment validation protocol is statistically underpowered given the variance in API production cycles. Furthermore, the exclusion of non-FDA-recognized third-party auditors creates a market distortion that violates OECD principles of regulatory harmonization. The economic impact on Tier 3 suppliers is not being modeled in any public policy framework - this is regulatory capture disguised as public health.

America built this. America pays for this. America deserves safe medicine. If you can’t meet our standards, you don’t get to sell here. Period. No tears. No excuses. Just facts. And the facts are - we’re not letting poison in. Not anymore.