When you hear "ACA plan," you might think it’s just another health insurance option. But here’s the truth: ACA plans are the only thing standing between millions of Americans and unaffordable, unusable health care. If you’re buying insurance on your own - whether you’re self-employed, between jobs, or just can’t get coverage through a spouse or employer - this is your lifeline. And right now, it’s on the edge.

What the ACA Actually Covers (No Fluff)

The Affordable Care Act didn’t just tweak insurance. It forced insurers to cover ten essential health benefits, no matter what plan you pick. That means every Bronze, Silver, Gold, or Platinum plan sold on HealthCare.gov must include:- Ambulatory care (doctor visits)

- Emergency services

- Hospitalization

- Pregnancy, maternity, and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative services and devices

- Laboratory services

- Preventive and wellness services

- Pediatric services, including dental and vision

That’s not optional. No insurer can dodge this. If a plan says it doesn’t cover mental health or maternity care? It’s not an ACA plan. Period. And if you’ve ever been denied coverage because of a pre-existing condition - asthma, diabetes, cancer, even pregnancy - that’s gone. Since 2014, insurers can’t say no. Not anymore.

How Premium Tax Credits Work (And Why They’re Disappearing)

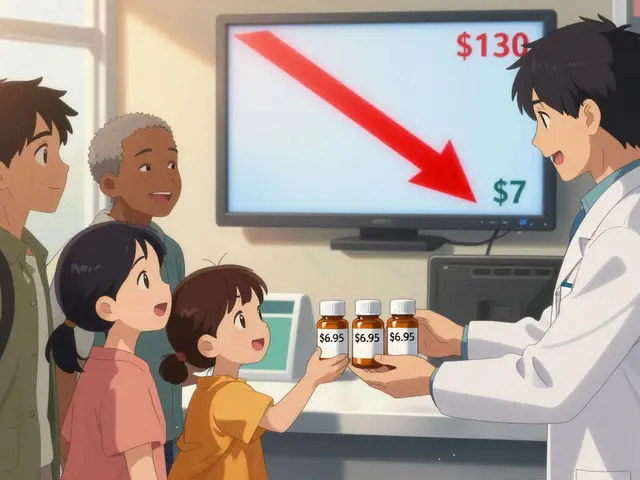

Here’s the real game-changer: premium tax credits. Before the ACA, if you made $50,000 a year and bought insurance alone, you might pay $534 a month. Now? With the enhanced credits from the American Rescue Plan and Inflation Reduction Act, that same person pays $247. That’s more than half off.But here’s the catch: those enhanced credits expire at the end of 2025. If Congress doesn’t act, the average monthly premium for a Silver plan will jump by $1,016 - a 114% increase. For a 60-year-old in some states, it could be worse: up to 192% more. That’s not a typo. That’s what the Kaiser Family Foundation confirmed in February 2025.

These credits aren’t a handout. They’re a math equation based on your income. If you make between 100% and 400% of the Federal Poverty Level (FPL), you qualify. For a single person in 2025, that’s $14,580 to $58,320. The Inflation Reduction Act temporarily removed the 400% cap - so even if you made $60,000, you still got help. That’s gone after 2025.

Plan Tiers: Bronze to Platinum - What You Really Get

The metal tiers aren’t marketing. They’re actuarial values. That means:- Bronze (60%): You pay 40% of costs. Lowest premiums, highest out-of-pocket. Good if you rarely see a doctor.

- Silver (70%): You pay 30%. This is where most people get subsidies. Also the only tier that qualifies for cost-sharing reductions (CSRs) if you make under 250% FPL.

- Gold (80%): You pay 20%. Higher premiums, lower deductibles. Best if you’re on regular meds or have frequent visits.

- Platinum (90%): You pay 10%. Highest premiums, lowest out-of-pocket. Only makes sense if you’re in and out of hospitals.

Most people pick Silver. Why? Because if you qualify for a subsidy, the government pays part of your premium AND reduces your deductible and copays. A Silver plan with CSR can cut your out-of-pocket max from $9,450 down to $2,750. That’s huge if you have a chronic illness.

What’s Changing in 2026 (And Why It Matters)

The Centers for Medicare & Medicaid Services (CMS) dropped a bomb in November 2025: the Marketplace Integrity and Affordability Final Rule. It’s not just paperwork. It changes how you prove your income.- Starting in 2026, you’ll need to update your income every quarter - not just at tax time.

- Fixed-dollar payment thresholds are gone. Insurers now use net percentage-based thresholds. Translation? Less guesswork, more accuracy.

- DACA recipients are no longer eligible. Around 550,000 people will lose coverage by 2026.

- The monthly Special Enrollment Period for those under 150% FPL is gone. That means if you lose your job in June, you might not be able to enroll until next year.

These changes sound technical, but they’re life-or-death for people with unstable income. One Reddit user, u/ACA_Warrior, shared how a 30% income drop mid-year led to $2,800 in unexpected medical bills because they couldn’t adjust their subsidy until tax filing. That’s changing - but too late for many.

Who’s Getting Left Behind?

The ACA works great if you’re between 100% and 400% FPL. But if you’re just above that? You’re in the gap. In states that didn’t expand Medicaid, people making $18,000 a year don’t qualify for Medicaid - but they also don’t qualify for subsidies. That’s over 2 million people in 10 states.And then there’s the "family glitch." Before 2023, if your employer offered cheap individual coverage but family coverage cost $1,200/month, your kids couldn’t get subsidies. Now? They can. That change alone added over 1 million new enrollees in 2024. But it’s still not perfect. Many still don’t know they qualify.

Real Stories: What People Actually Experience

Sarah K., a freelance writer in Ohio, told HealthCare.gov: "I make $32,000. My Silver plan costs $0. I get full cost-sharing reductions. I’ve never paid a deductible." That’s real. That’s the ACA working.But then there’s u/HealthyInTX on Reddit: "I got a $0 premium plan. Then I had to file three corrected tax returns because my income changed. I got hit with a $4,200 tax bill." That’s the flip side. The system works - but it’s brittle. One missed pay stub, one freelance gig, one layoff - and you’re in a mess.

According to CMS’s 2025 survey, 92% of people with chronic conditions say eliminating pre-existing condition exclusions was the most valuable part of the ACA. That’s not abstract. That’s someone with diabetes, cancer, or heart disease breathing easier.

How to Enroll (And What to Bring)

If you’re planning to enroll for 2026, here’s what you need:- Your Social Security number

- Proof of income: W-2s, recent pay stubs, or tax returns if self-employed

- Proof of citizenship or immigration status

- Household size (who lives with you)

The average application takes 45 minutes. But if you’re self-employed? Add 6-8 hours. Why? Because calculating Modified Adjusted Gross Income (MAGI) is confusing. CMS found a 32% error rate in subsidy estimates for freelancers in 2025. You can’t wing it.

Use HealthCare.gov’s plan comparison tool. It’s updated for 2026 as of October 1, 2025. Filter by:

- County

- Income

- Medication list

- Preferred doctors

Don’t just pick the cheapest premium. Check the formulary. Does your insulin, your asthma inhaler, your blood pressure med - are they covered? And at what tier? A $0 premium plan means nothing if your meds aren’t covered.

What’s Next? The Cliff Is Coming

The ACA has saved millions. But its future is hanging by a thread. If enhanced tax credits expire, enrollment could drop 15-20% in 2026. States that didn’t expand Medicaid will see premiums jump over 150% for many. The market could destabilize. Experts warn of a "death spiral" - healthier people drop out, leaving sicker, costlier enrollees, which drives premiums even higher.Right now, 17.3 million people are enrolled. That’s a record. But it’s also a warning. If Congress doesn’t act, that number will fall. And the people who lose coverage? They’re not the wealthy. They’re the teachers, the gig workers, the small business owners, the parents who can’t afford employer coverage.

The ACA isn’t perfect. It’s complicated. It’s frustrating. But it’s the only system that says: you can’t be denied because you got sick. You can’t be priced out because you’re not rich. And for now - until December 31, 2025 - it still works.

Write a comment