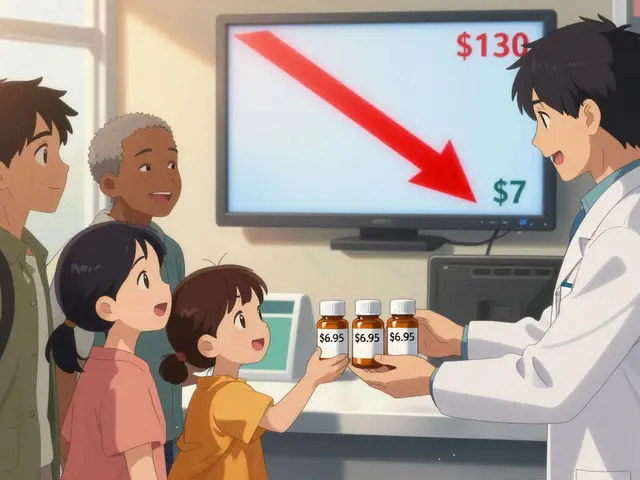

The global generic drug market isn’t just about cheap pills. It’s the backbone of affordable healthcare for billions. By 2025, generic medications make up over 90% of prescriptions in the U.S. and nearly 70% across Europe - yet they account for less than a quarter of total drug spending. That’s the power of generics: delivering the same active ingredients as brand-name drugs at 80-85% lower cost. But the future? It’s not just about more low-cost pills. It’s about complexity, geography, regulation, and a quiet revolution in how these drugs are made.

Why Generics Are More Important Than Ever

Healthcare costs hit $9.8 trillion globally in 2024. Chronic diseases like diabetes, heart disease, and cancer affect over 40% of the world’s population. Governments can’t keep paying for expensive branded drugs. That’s where generics step in. In India, the National Pharmaceutical Pricing Authority keeps prices low so millions can access insulin, blood pressure meds, and antibiotics. In Brazil and Nigeria, public health programs rely on generics to cover basic care. Without them, entire health systems would collapse under financial strain. The numbers don’t lie. The market was worth $435 billion in 2023 and is on track to hit $655 billion by 2028. But growth isn’t uniform. In the U.S. and Western Europe, price controls and aggressive bidding have squeezed margins. Generic manufacturers now earn just 12% profit on average - down from 18% in 2020. Meanwhile, in emerging markets like India, Turkey, and Saudi Arabia, demand is exploding. These regions are adding $140 billion in drug spending by 2025, and generics are carrying most of that load.The Rise of Biosimilars: The New Frontier

The biggest shift isn’t in small-molecule generics anymore. It’s in biosimilars. These are copies of complex biologic drugs - like Humira, Enbrel, or Keytruda - used for cancer, autoimmune diseases, and rare conditions. Unlike traditional generics, biosimilars aren’t chemical copies. They’re made from living cells, requiring 10 to 20 times more manufacturing steps. Development costs? $100-250 million per product, compared to $1-5 million for a standard generic. But here’s the catch: biosimilars don’t sell at 80% discounts. They’re priced 15-30% below the original biologic. Why? Because the science is harder, the factories are more expensive, and regulators demand more data. Still, the market is growing fast. Mordor Intelligence projects a 12.3% annual growth rate for biosimilars from 2025 to 2030. Companies like Sandoz, Amgen, and Mylan are investing billions to enter this space. And it’s not just big players. India’s Biocon and China’s WuXi Biologics are building biosimilar pipelines to compete globally. This shift is changing who wins in generics. Small manufacturers that once thrived on simple pills now struggle to afford the labs, clean rooms, and regulatory expertise needed for biosimilars. The market is becoming a two-tier system: low-cost volume players and high-tech specialty firms.Who Makes the World’s Generics? It’s Not What You Think

When you think of generic drugs, you probably think of India. And you’re right - but not the whole story. India produces over 60,000 generic medicines and supplies 20% of the world’s generic drug volume by volume. It’s the pharmacy of the developing world. But China controls the supply chain. It makes about 40% of the world’s active pharmaceutical ingredients (APIs) - the actual chemical building blocks of drugs. And here’s the risk: China supplies 65% of all APIs used in global generic production. That means if there’s a shutdown, a trade ban, or a quality failure in one Chinese factory, it can ripple across continents. The U.S. FDA issued 187 warning letters to foreign generic manufacturers in 2023. Forty percent of those were tied to facilities in India and China, mostly over poor sanitation, data integrity issues, or unapproved process changes. These aren’t minor slips. They’re systemic risks. The FDA’s warning in 2024 was blunt: “Quality control in the global supply chain remains a major concern.” That’s why countries are pushing back. The U.S. is trying to reshore API production. The EU is tightening inspections. India launched a $1.34 billion Production Linked Incentive (PLI) scheme in 2024 to boost domestic API manufacturing. Saudi Arabia and Egypt are mandating local production of essential medicines. The goal? Reduce dependence on a single country - even if it means higher prices in the short term.

Regional Wars: Who’s Winning and Who’s Losing

The global generic market isn’t one big pool. It’s a patchwork of regional battles. In North America and Western Europe, growth is slow - just 2-5% annually. Why? Price caps. Regulators force generics into bidding wars. One company cuts price by 10%, another cuts 15%, and profit vanishes. The result? Many small manufacturers have shut down. Only the biggest, like Teva and Sandoz, survive. In Asia-Pacific, it’s a different story. India and China together control 35% of global manufacturing capacity. India dominates finished drug exports. China dominates raw materials. Together, they’re building a self-sustaining ecosystem. Vietnam, Thailand, and Indonesia are now emerging as regional hubs, exporting to Africa and Latin America. The Middle East is the surprise player. Saudi Arabia’s Vision 2030 isn’t just about oil. It’s about becoming a health hub. The country is investing in local drug production, building regulatory agencies, and offering tax breaks to generic makers. The GCC pharmaceutical market is projected to hit $9.89 billion by 2025. Egypt wants 50% of its essential medicines made locally by 2025. These aren’t just policies - they’re national security moves. Africa? Still underdeveloped. But with rising insurance coverage and donor funding, countries like Kenya and Nigeria are starting to import bulk generics and assemble them locally. The demand is there. The infrastructure? Still catching up.The Real Threat: Losing Market Share to Specialty Drugs

Here’s the uncomfortable truth: generics are winning in volume - but losing in value. In 2024, generics made up 57.56% of the global pharmaceutical market by volume. But by 2030, that number is projected to drop to 53%. Why? Because the most profitable drugs aren’t generics anymore. They’re specialty drugs - GLP-1 weight-loss medications, gene therapies, personalized cancer treatments. These drugs cost tens of thousands of dollars per year. And they’re growing fast. Evaluate Pharma forecasts global prescription drug sales will hit $1.7 trillion by 2030. But generics will only capture a shrinking slice of that pie. The market is splitting: one side for low-cost, high-volume generics; the other for high-price, low-volume specialty drugs. Generics aren’t disappearing. They’re being pushed to the base of the pyramid. That’s a problem for manufacturers. If you’re a generic company that only makes pills for high blood pressure or cholesterol, your future is tight margins and shrinking demand. To survive, you need to move up - into biosimilars, complex formulations, or contract manufacturing for biotech firms.What’s Next? Five Predictions for 2030

1. Biosimilars will be the new standard - Not just for cancer, but for rheumatoid arthritis, psoriasis, and diabetes. By 2030, half of all biologic prescriptions in developed countries will be biosimilars. 2. API supply chains will fracture - No single country will control more than 30% of global API production. India, the U.S., the EU, and Southeast Asia will each build their own secure supply lines. 3. Regulation will tighten globally - The ICH guidelines (International Council for Harmonisation) are now adopted by 72 countries. By 2030, nearly every major market will use the same standards. That means fewer rejections, but higher compliance costs. 4. Manufacturers will become service providers - Companies won’t just sell pills. They’ll offer supply chain management, digital tracking, and even patient adherence programs. Think of them as healthcare logistics partners, not just drug makers. 5. Price pressure will shift to emerging markets - As India and China grow, they’ll start demanding higher prices for their exports. The era of ultra-cheap generics from Asia may be ending.Final Thought: Generics Are the Unsung Hero of Global Health

They don’t get headlines. They’re not flashy. But without generics, millions wouldn’t have access to life-saving medicine. The future won’t be about more cheap pills - it’ll be about smarter, safer, more reliable ones. The winners won’t be the cheapest. They’ll be the most trustworthy.Are generic drugs as safe as brand-name drugs?

Yes - if they’re made by reputable manufacturers under strict regulations. The FDA and EMA require generics to have the same active ingredient, strength, dosage form, and bioavailability as the brand-name version. The only differences are in inactive ingredients like fillers or coatings, which don’t affect how the drug works. However, quality issues in some foreign factories - especially those flagged by the FDA - can compromise safety. That’s why regulatory oversight is critical.

Why are biosimilars more expensive to make than regular generics?

Biosimilars are made from living cells, not chemicals. That means the manufacturing process is far more complex - involving bioreactors, precise temperature controls, and weeks of purification. A single batch can take months to produce. Small variations can change how the drug behaves in the body. That’s why developers must run dozens of clinical tests to prove similarity. A regular generic? Just a chemical synthesis. It’s like comparing a hand-built car to a mass-produced one.

Which countries are the biggest producers of generic drugs?

India and China are the top two. India leads in finished drug exports - producing over 60,000 generic medicines and supplying 20% of the world’s volume. China dominates the supply of active pharmaceutical ingredients (APIs), making about 40% of the world’s raw drug components. Other growing players include Germany, the U.S., and now Vietnam and Egypt, as they build local manufacturing capacity.

Why do generic drug prices keep falling?

It’s competition. When a brand-name drug’s patent expires, multiple generic companies enter the market. They all want to win contracts with insurers and pharmacies. So they undercut each other. In the U.S., the first generic often gets a 30-40% discount. By the time 10 companies are selling it, the price drops 80-90%. This is great for patients - but it squeezes profits, forcing smaller manufacturers out of business.

Will generic drugs become obsolete in the future?

No. Even as specialty drugs grow, the need for affordable, everyday medicines won’t disappear. Chronic diseases like diabetes, hypertension, and asthma affect billions. These conditions require lifelong treatment - and most patients can’t afford $10,000-a-year drugs. Generics will remain essential for basic care. The shift isn’t away from generics - it’s toward higher-value generics like biosimilars and complex formulations. The market is evolving, not disappearing.

Comments

Okay but let’s be real-this whole post is just a glorified investor pitch with extra steps. 🤡 I mean, biosimilars? Please. It’s just Big Pharma’s way of keeping the gravy train rolling while pretending they care about ‘affordable healthcare.’ 🥲 Meanwhile, my grandma’s insulin still costs $400 because ‘supply chain fragmentation’ is more important than her life. 🤦♂️

It’s fascinating how we romanticize ‘affordability’ while ignoring the human cost behind it. The factories in India and China? They’re not just producing pills-they’re producing dignity for millions who otherwise wouldn’t have access. But we treat their labor like disposable packaging. 🤔 Maybe the real revolution isn’t in biosimilars-it’s in recognizing that healthcare isn’t a commodity. It’s a right. And rights don’t come with a 12% profit margin.

I’ve been in this industry for 27 years, and I’ve seen every wave come and go. The idea that generics are ‘just cheap pills’ is dangerously naive. These aren’t aspirin. We’re talking about complex, life-sustaining molecules made under conditions most Americans wouldn’t tolerate in their kitchens. The real threat isn’t biosimilars-it’s complacency. We’re outsourcing not just manufacturing, but moral responsibility. And that’s the real crisis.

THEY’RE LYING TO YOU!!! THE FDA IS IN BED WITH CHINA!!! THEY KNOW THE API FACTORIES ARE CONTAMINATED BUT THEY LET IT HAPPEN BECAUSE THEY’RE PAID OFF BY BIG PHARMA!!! YOU THINK YOUR BLOOD PRESSURE PILLS ARE SAFE?? THINK AGAIN!!! I SAW A VIDEO ON TRUTH SOCIAL WHERE A MAN IN INDIA WAS USING A TOASTER TO STERILIZE DRUGS!!! IT’S TRUE!!! I SAW IT!!!

India makes so many generics because we know what it means to wait for medicine... my uncle died because he couldn't afford the branded version of his heart drug... now he's alive because of a 50 rupee tablet... but the world still calls us 'cheap'... we're not cheap we're just surviving... and now they want to take our API market too?... i hope we build more factories not less... love from bangalore 🙏

China controls 65% of APIs... that’s not a supply chain. That’s a weapon. 🚨 The next pandemic won’t be viral-it’ll be pharmaceutical. And we’re all just waiting for the switch to flip. 💉

While the economic and logistical dimensions of this transformation are undeniably significant, it is imperative that we approach this evolution with a framework grounded in ethical stewardship and global equity. The fragmentation of supply chains, while ostensibly a strategic imperative, must not exacerbate disparities in access. Regulatory harmonization, if implemented equitably, may serve as a vehicle for universal standards rather than a barrier to entry for emerging producers. We must ensure that the pursuit of resilience does not eclipse the imperative of accessibility.

India's PLI scheme is a classic case of state-driven overreach. You think $1.34B will fix decades of underinvestment in R&D infrastructure? The real ROI is in export subsidies, not domestic manufacturing. China has 40% of API production because they invested in scale, not sentiment. Your 'pharmacy of the world' is just a glorified contract manufacturer with a nationalist slogan. Wake up.

I think about the people who take these pills every day-the ones who don’t get to choose between rent and medicine. The biosimilars? The supply chain shifts? The regulatory battles? They’re all important. But none of it matters if we forget that behind every pill is someone’s mother, their child, their neighbor. We’re not talking about markets. We’re talking about lives. And if we lose sight of that, no amount of innovation will save us.

Let’s address the elephant in the room: if biosimilars are so complex and expensive, why are we still letting them be priced at only 15-30% below the original? That’s not competition-it’s collusion. The same companies that make the biologics are the ones buying up the biosimilar pipelines. This isn’t innovation-it’s monopolistic rebranding. And the FDA’s ‘strict standards’? They’re just a velvet glove over an iron fist. We need transparency, not more regulations written by the same lobbyists who wrote the original patents.

my dad’s been on a generic blood pressure med for 12 years. never had an issue. never even knew it wasn’t the brand name. the real story here isn’t about biosimilars or supply chains-it’s about how we’ve been conditioned to think expensive = better. it’s not. it’s just more marketing. and honestly? i’m tired of it.

This post is so boring it’s almost criminal. You spent 1,000 words saying generics are important. Congrats. Newsflash: water is wet. Who cares? Move on.