Running out of medication because you can’t afford it isn’t just stressful-it’s dangerous. In 2025, nearly 1 in 4 Americans skip doses or delay refills because of cost. The good news? You’re not powerless. Whether you’re on Medicare, private insurance, or paying cash, there are real, proven ways to cut your medication bills-without sacrificing your health.

Generic Drugs: The Secret Weapon Most People Ignore

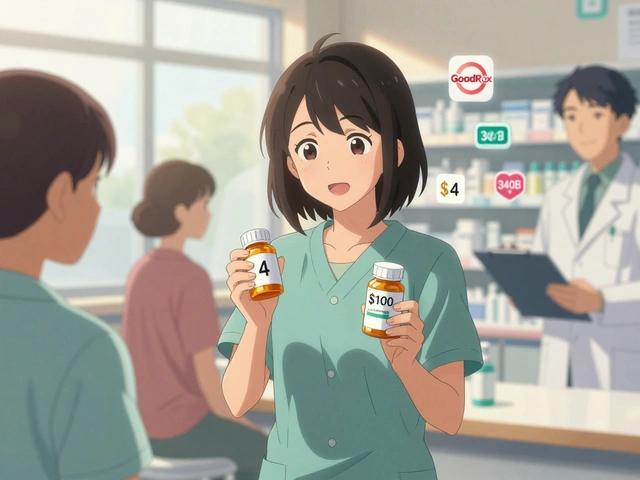

Generic drugs aren’t second-rate. They’re the exact same medicine as the brand-name version, just without the marketing budget. The FDA requires generics to have the same active ingredient, strength, dosage form, and effectiveness as the original. The only differences? The color, shape, or inactive fillers-and the price.On average, generics cost 80% to 85% less than brand-name drugs. For example, metformin (used for diabetes) costs about $4 for a 30-day supply as a generic. The brand-name version, Glucophage, can run over $100. Same pill. Same results. Just a fraction of the cost.

But here’s the catch: your doctor might not automatically prescribe the generic. If you’re handed a brand-name script, ask: “Is there a generic available?” Most of the time, yes. And if your pharmacist says no, ask them to check other pharmacies. Some insurers still steer patients toward brand names for rebates-but you’re the one paying the bill.

Even for newer drugs, generics are coming fast. In 2025, the first generic versions of popular GLP-1 weight-loss drugs like semaglutide (Ozempic, Wegovy) are expected to hit the market. That could slash prices from $1,000+ per month to under $100. Waiting a few months might save you thousands.

Coupons and Discount Programs: Not All Are Created Equal

You’ve seen those coupons: “Save $50 on your next prescription!” But not all coupons actually help. Some are just marketing tricks.Manufacturer coupons (from companies like Pfizer or Novo Nordisk) can be great-if you’re paying out-of-pocket. But if you’re on Medicare Part D, those coupons don’t count toward your deductible or out-of-pocket cap. In fact, they can hurt you. Why? Because they artificially lower your spending, which delays when you hit the $2,000 out-of-pocket cap that kicks in full coverage in 2025.

Instead, use pharmacy discount cards like GoodRx, SingleCare, or RxSaver. These aren’t coupons-they’re cash prices negotiated directly with pharmacies. They work whether you have insurance or not. And they often beat even Medicare’s negotiated prices.

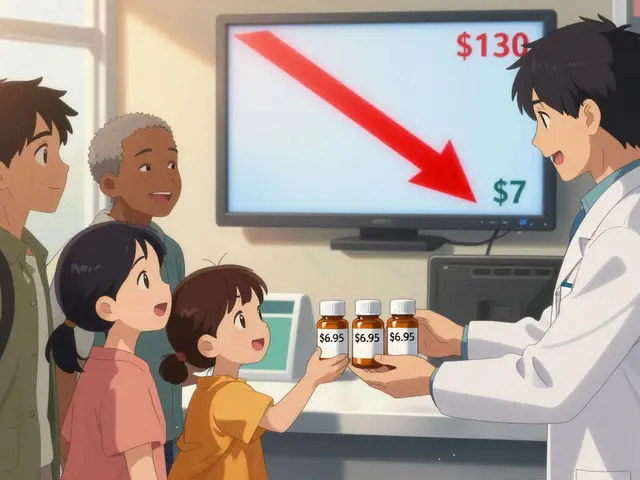

For example, a 30-day supply of lisinopril (a blood pressure drug) might cost $12 with insurance, $8 with GoodRx, and $4 with a 340B pharmacy (more on that later). Always check multiple sources before paying at the counter.

Mark Cuban’s Cost-Plus Drugs is another option. It sells generics and some brand-name drugs at a fixed markup over wholesale cost-no middlemen, no markups. You can get 100 pills of atorvastatin (Lipitor) for $10. No coupon needed. Just pay what it costs the pharmacy to buy it, plus $5.

Prior Authorization: The Hidden Bureaucratic Hurdle

Prior authorization is when your insurance says, “We won’t pay for this drug unless we approve it first.” Sounds simple, right? It’s not.Insurance companies use prior authorization to block expensive drugs and push you toward cheaper alternatives-even if your doctor says you need the original. For example, your doctor prescribes a newer, more effective asthma inhaler. Your insurer says, “Try the older one first.” That older one might cause more side effects or require more doses. But it’s cheaper for them.

The process can take days-or weeks. During that time, you might go without your medication. And if the request is denied? You’ll have to appeal, which can take another 30 to 60 days.

Here’s what to do:

- Ask your doctor to submit the prior auth request immediately when writing the prescription.

- Call your insurer and ask for the exact reason they’re denying coverage. Get it in writing.

- Ask your doctor to write a letter of medical necessity explaining why the cheaper option won’t work for you.

- If denied, file an appeal. You have the right to do so.

Some states now require insurers to approve prior authorizations within 24 to 72 hours for urgent medications. If you’re on a life-sustaining drug like insulin or heart medication, mention “urgent” and push hard.

Medicare Part D Changes in 2025: What You Need to Know

If you’re on Medicare, 2025 is a game-changer. For the first time, there’s a hard cap on out-of-pocket drug costs: $2,000 per year. Once you hit that, your plan pays 100% for the rest of the year.And the dreaded “donut hole”? Gone. Before 2025, you’d hit a coverage gap where you paid 25% to 50% of the cost-even if you’d already spent thousands. Now, there’s no gap. You pay your deductible, then your coinsurance, then you hit the cap and everything’s covered.

Plus, the first 10 drugs negotiated by Medicare under the Inflation Reduction Act will see price drops starting January 2026. Drugs like insulin, Eliquis, and Jardiance will be significantly cheaper for Medicare beneficiaries. The average savings? Around $400 per year per person.

But here’s the trick: you still have to choose the right Part D plan. Not all plans cover the same drugs. And even with the cap, your monthly premium might be higher. Use the Medicare Plan Finder tool to compare plans based on your exact medications-not just the cheapest premium.

How Medicaid and 340B Programs Can Help

If you’re on Medicaid, the GENEROUS Model (launched in 2025) is your new best friend. It’s a CMS program that negotiates drug prices directly with manufacturers-so Medicaid pays what other countries pay for the same drugs. That means you could see your copay drop from $50 to $5 overnight.Even if you’re not on Medicaid, you might still qualify for 340B pricing. The 340B Drug Pricing Program lets certain clinics, hospitals, and pharmacies buy drugs at deeply discounted rates to serve low-income patients. You don’t need to be poor-just get your prescription filled at a 340B-participating pharmacy.

Use the 340B Drug Pricing Program database to find nearby pharmacies. Many community health centers, VA hospitals, and even some chain pharmacies like CVS and Walgreens participate. Bring your prescription there and ask: “Do you offer 340B pricing?”

What to Do Right Now: A Simple Action Plan

You don’t need to wait for policy changes or insurance approvals. Here’s what to do today:- Ask your doctor: “Is there a generic version of this drug?”

- Check GoodRx or RxSaver for cash prices before you fill any script.

- If you’re on Medicare, log into Medicare.gov and compare your Part D plan with others using your exact medications.

- If your drug requires prior authorization, call your insurer and ask for the denial reason in writing.

- Find a 340B pharmacy near you-even if you’re not on Medicaid.

- For long-term medications, consider switching to a 90-day supply. Many plans offer lower copays for bulk refills.

One patient, 68, saved $1,200 last year just by switching her insulin from a brand-name to a generic and using a 340B pharmacy. She didn’t change her diet. She didn’t change her doctor. She just changed where she filled her prescription.

Why This Matters More Than You Think

Medication costs aren’t just about money. They’re about survival. People die because they can’t afford their pills. A 2024 study in JAMA found that patients who skipped insulin due to cost were twice as likely to be hospitalized for diabetic ketoacidosis.But change is happening. The Inflation Reduction Act, Medicare negotiations, state affordability boards, and pharmacy discount programs are all working together to break the old system. You’re not just a patient-you’re a participant in that change.

Every time you ask for a generic, check a discount card, or challenge a prior auth denial, you’re not just saving yourself money. You’re pushing the system toward fairness.

Can I use a manufacturer coupon with Medicare Part D?

Yes, you can use them-but they won’t count toward your $2,000 out-of-pocket cap. That means they might delay when you reach full coverage. For Medicare users, cash discount cards like GoodRx often give better long-term savings than manufacturer coupons.

Why is my generic drug suddenly more expensive?

Generic prices can spike due to supply shortages, manufacturing issues, or reduced competition. If your generic suddenly costs more, ask your pharmacist if another manufacturer makes the same drug. Sometimes switching to a different generic brand drops the price back down.

What if my insurance denies my prior authorization?

You have the right to appeal. Ask your doctor to write a letter explaining why the alternative drug won’t work for you. Include medical records. Submit your appeal in writing and keep copies. If it’s denied again, you can request an external review by an independent third party.

Are all generics the same quality?

Yes. All generics must meet the same FDA standards as brand-name drugs. They use the same active ingredient, work the same way, and are tested for safety and effectiveness. Differences in fillers or color don’t affect how the drug works.

Can I buy medications from Canada to save money?

While many people do, it’s technically illegal under U.S. law. However, the FDA has stated it generally doesn’t pursue individuals who import small amounts for personal use. Some states now allow certified Canadian pharmacies. Check your state’s rules. Alternatively, use U.S.-based 340B pharmacies or Cost-Plus Drugs for legal, low-cost options.

How do I know if my pharmacy is 340B eligible?

Go to the HRSA 340B Drug Pricing Program website and use their pharmacy locator tool. Enter your zip code. You’ll see a list of clinics, hospitals, and pharmacies that offer 340B pricing. Call ahead to confirm they’ll apply it to your prescription.

What’s Next? Staying Ahead of Drug Cost Changes

In 2026, Medicare will negotiate 15 more drugs. By 2029, it could be 30 per year. More states are launching drug affordability boards. Insurers are being forced to limit PBM rebates that inflate prices. The system is shifting-and you need to stay informed.Sign up for alerts from Patients For Affordable Drugs or the Kaiser Family Foundation. Check your Part D plan every fall during open enrollment. Always ask about generics and discounts. And never accept “that’s just how it is” as an answer.

Medication costs are broken-but they’re not unfixable. You have tools. You have rights. And you’re not alone.

Comments

This is life-changing info 😍 I just switched my metformin to generic and used GoodRx-paid $3.50. My pharmacist didn’t even mention it. Why do they hide this stuff?

Stop giving out free advice. If you can't afford meds, get a better job.

I’ve been begging my doctor for generics for YEARS and they act like I’m asking them to perform surgery with a butter knife. And don’t even get me started on prior auth-my insurance made me wait 47 days for an insulin refill last winter. I had to beg my neighbor for a spare pen because I was shaking from low blood sugar. This isn’t healthcare. This is a hostage situation with a pharmacy counter. And now they want us to be grateful for a $2000 cap? That’s the bare minimum. I’m not a statistic. I’m a person who’s had to choose between my meds and my daughter’s school supplies. And yes I cried. Yes I screamed into a pillow. And yes I’m still mad. And I’m not sorry.

The real issue isn’t drug pricing-it’s the moral decay of a society that lets corporations profit off suffering. We’ve turned healing into a commodity, and now we’re surprised when people die because they can’t afford to live. The FDA approves generics but the PBM middlemen? They’re the real villains. They’re the ones who pocket the rebates while you’re rationing pills. This isn’t capitalism-it’s medical feudalism. And until we treat health as a human right and not a privilege for the financially blessed, we’re all just rearranging deck chairs on the Titanic.

The structural inefficiencies within the PBM ecosystem are non-trivial. The rebate-driven model incentivizes formulary placement over clinical efficacy, which creates misaligned outcomes. The 340B program represents a necessary but underutilized intervention in the supply chain. A systemic recalibration toward transparent pricing mechanisms would significantly mitigate patient financial toxicity.

u kno what they r not telling u? the gov is secretly selling our meds to china and replacing them with fake ones. thats why the generics r so cheap-bc they r not even real. i saw a vid on 4chan. u cant trust the fda. they r in on it. check the batch numbers. they all start with 666

Dear fellow citizens, I must respectfully bring to your attention the extraordinary ethical imperative of pharmaceutical affordability. While I wholeheartedly endorse the utilization of GoodRx and 340B pharmacies, I implore you to also consider the broader sociopolitical implications of this crisis. The commodification of life-saving therapeutics is not merely a market failure-it is a profound betrayal of the social contract. I have personally written to five senators. I recommend you do the same. Sincerely, Bethany Hosier, M.A. in Bioethics

I used to think generics were just as good until my cousin died after taking one. They don't test them right. I won't risk it again. No amount of savings is worth your life.

i just want to say thank you for writing this. i was scared to ask my doctor for a generic bc i thought theyd think i was cheap. turns out they were relieved i asked. i used goodrx and saved $80 on my blood pressure med. no one talks about this stuff. we need more of this

the system is rigged and everyone knows it but no one wants to admit it. i got denied prior auth for my heart med so i drove to a 340b clinic 40 miles away. paid $12. my insurance wouldve charged me $210. they dont want you to know this exists. they want you to suffer quietly. i wont be quiet anymore

you said it better than i could. i just want to add that if you’re on medicaid the new generous model is a game changer. my copay for lisinopril dropped from $45 to $3. i cried. not because i was happy. because i realized how long i’ve been begging for basic dignity