Every year, Americans fill over 3.9 billion prescriptions for generic drugs. That’s nearly 9 out of every 10 prescriptions written. Yet, these same generics make up just 12% of total prescription drug spending. Meanwhile, brand-name drugs-only 10% of prescriptions-consume 88% of the money spent on meds. This isn’t a glitch. It’s the system working exactly as designed.

How Much Do You Actually Save With Generics?

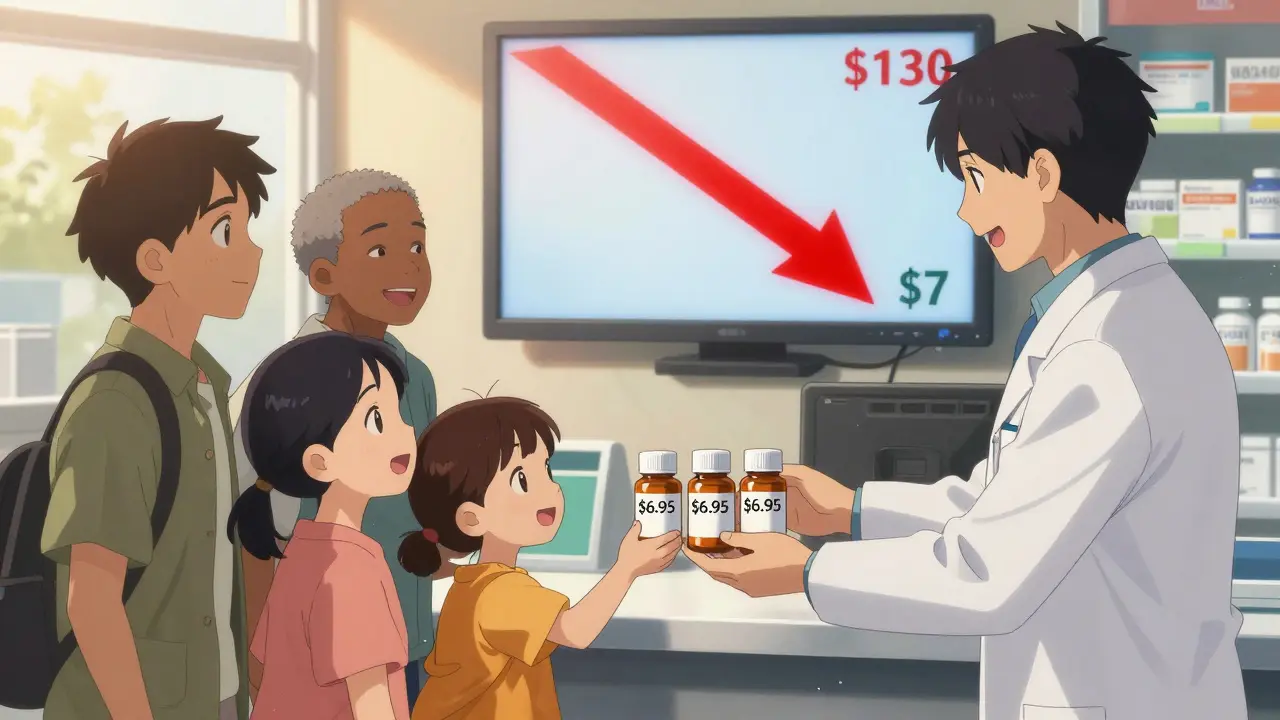

In 2024, the average out-of-pocket cost for a generic prescription was $6.95. For the same medicine in brand form? $28.69. That’s not a small difference-it’s almost five times more. If you’re uninsured, the gap widens even further. Brand-name drugs cost $130.18 per prescription on average, up 50% since 2019. Generics? They dropped by $2.45 over the same period.

That’s not just pocket change. For someone taking three generics a month, that’s $250 saved annually. For a family on multiple prescriptions, it’s thousands. And it adds up fast across the whole system. In 2023 alone, generic and biosimilar drugs saved the U.S. healthcare system $445 billion. Over the last decade, those savings hit $3.4 trillion.

Why Are Generics So Much Cheaper?

It’s not because they’re weaker. It’s because they don’t need to repeat the same billion-dollar clinical trials. The Hatch-Waxman Act of 1984 created a shortcut: if a generic drug has the same active ingredient, dose, and effect as the brand, it can be approved without starting from scratch. That’s why over 16,000 generic drugs are on the market today.

Manufacturers don’t need to pay for advertising, celebrity endorsements, or fancy packaging. They don’t need to recoup R&D costs that often run into the billions. Their only real expense is making the pill-and they compete fiercely on price. One company makes a generic version of metformin. Another makes it cheaper. Then another undercuts them. The price drops. Patients win.

What About Biosimilars? They’re the Next Big Thing

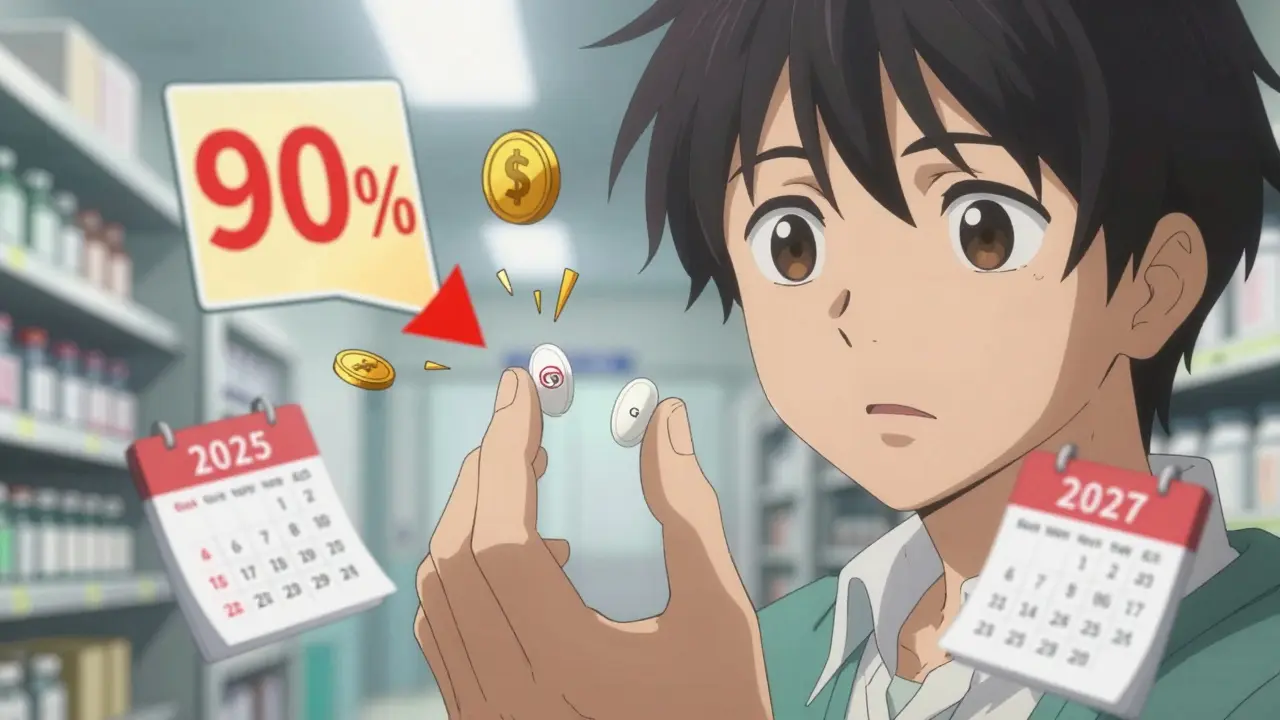

Biosimilars are the generic version of complex biologic drugs-things like insulin, rheumatoid arthritis treatments, and cancer therapies. These used to cost $1,000 a month or more. Now, some biosimilars cost 90% less. Take Stelara, a drug for Crohn’s disease and psoriasis. When nine biosimilar versions hit the market in 2025, the list price dropped from $9,000 per year to under $1,000.

Since biosimilars launched, they’ve saved $56.2 billion in the U.S. And in 2024, they saved $20.2 billion in just one year. Oncology biosimilars alone cut cancer drug spending growth in half since 2019, saving $18 billion in 2020. Yet, even with these wins, biosimilars still make up less than 30% of prescriptions in their markets. There’s room to grow-and huge savings still on the table.

The 90/13 Paradox: Why the System Still Feels Broken

Here’s the strange part: even though generics handle 90% of prescriptions, they only cost 12% of the total. That’s the 90/13 paradox. It’s not a failure-it’s proof that generics work. But it also exposes how broken the brand-name market is.

Brand companies don’t compete on price. They compete on patents. Some drugs have over 75 patents stacked on top of each other, stretching monopolies from 2016 all the way to 2034. This is called “patent thickets.” It’s legal, but it’s not fair. Blue Cross Blue Shield estimates these tactics cost consumers $3 billion a year. Pay-for-delay deals-where brand companies pay generics to stay off the market-add another $12 billion in unnecessary costs annually.

That’s why, even with all the savings, people still feel priced out. A drug like Entresto, which treats heart failure, brought in $5.4 billion in 2023. When its patent expires in late 2025, generic versions will likely cut that price by 80-90%. That’s $4 billion in savings just for one drug.

What’s Holding Generics Back?

It’s not the science. It’s the rules. Only 42 states have updated their pharmacy laws to let pharmacists automatically switch a brand to a generic unless the doctor says no. In the other eight, you still have to ask. That’s outdated. It slows access and adds paperwork.

Doctors don’t always know when a patent expires. The FDA updates its Orange Book every month with new generic approvals, but most clinics don’t have systems to track it. Pharmacies are stuck with formularies that favor brands because of rebates from manufacturers. PBMs-pharmacy benefit managers-get paid to push certain drugs, even if they’re more expensive.

And then there’s the fear. Some patients swear their brand-name version works better. The FDA says this happens in less than 1% of cases, mostly with narrow therapeutic index drugs like warfarin or thyroid meds. Even then, switching between generic manufacturers is usually fine. If you feel different after a switch, talk to your doctor. But don’t assume it’s the generic’s fault.

Who’s Winning? Who’s Losing?

Tea, Mylan (now Viatris), and Sandoz control about 35% of the generic market. They’re the big players. But there are over 150 manufacturers competing. That’s why prices keep falling.

Patients win. Medicare and Medicaid win. Employers win. In one Kaiser Permanente study, switching to generics cut pharmacy costs by 25-35% in under two years.

But brand-name drugmakers? They’re losing market share. Their revenue per prescription is falling. So they fight back-not with better drugs, but with legal tricks. Patent extensions. Product hopping (changing the pill’s shape or form just to reset the patent clock). These aren’t innovations. They’re delays.

What’s Changing in 2025 and Beyond?

The FDA approved 745 new generic drugs in 2024-up 12% from the year before. More are coming. Entresto, Tradjenta, and Opsumit are all set to lose patent protection in late 2025. Combined, those three drugs made $8.6 billion last year. Once generics hit, that money goes back into patients’ pockets and the healthcare system’s budget.

Lawmakers are starting to act. The Affordable Prescriptions for Patients Act and the Drug Competition Enhancement Act both passed key committees in early 2025. They target patent thickets and product hopping. If they become law, savings could jump another $3 billion a year.

The Biden administration’s 2025 health plan puts biosimilars front and center. Reducing regulatory red tape is now a top priority. More doctors are being trained to prescribe them. More insurers are mandating generics. Eighty-seven percent of commercial health plans now require generic substitution when available.

What Should You Do?

Ask your doctor if there’s a generic version of your prescription. Don’t assume the brand is better. Ask your pharmacist to check if a cheaper generic is available-even if your doctor didn’t prescribe it. Ask if your insurance has a preferred generic. Call your pharmacy and compare prices. Some discount programs, like GoodRx, can cut your cost even further.

If you’re on Medicare, check your Part D plan’s formulary. Many have lower copays for generics. If you’re uninsured, look into patient assistance programs. Most brand-name manufacturers offer them-but so do generic makers now, too.

And if your doctor says, “This brand is necessary,” ask why. Is it because of a patent? A rebate? Or because they genuinely believe you need it? You have the right to know.

Generic drugs aren’t a compromise. They’re the smart choice. They’re safe. They’re effective. And they’re saving billions-every single year. The question isn’t whether you should use them. It’s why anyone still pays full price for a brand when a generic exists.

Are generic drugs as safe and effective as brand-name drugs?

Yes. The FDA requires generic drugs to have the same active ingredients, strength, dosage form, and route of administration as the brand-name version. They must also meet the same strict manufacturing standards. Bioequivalence studies prove they work the same way in the body. Less than 1% of patients report noticeable differences, mostly with narrow therapeutic index drugs like warfarin or levothyroxine. For most people, generics are just as safe and effective.

Why do some people say generic drugs don’t work as well?

Sometimes, it’s psychological. People associate brand names with quality. Other times, switching between different generic manufacturers can cause minor variations in inactive ingredients-like fillers or dyes-which rarely affect how the drug works. In rare cases, patients with sensitive conditions (like epilepsy or thyroid disorders) may notice small changes. If that happens, stick with one generic manufacturer or ask your doctor to write "Do Not Substitute." But for 99% of prescriptions, this isn’t an issue.

Can I save money by switching to a generic even if my insurance covers the brand?

Absolutely. Even with insurance, you might pay a higher copay for a brand-name drug. Many plans have tiered pricing: generics are Tier 1 (lowest cost), brands are Tier 2 or 3. Sometimes, the generic’s cash price without insurance is lower than your brand copay. Always ask your pharmacist to check both. You could save $20, $50, or even $100 per month just by switching.

What’s the difference between a generic and a biosimilar?

Generics are exact copies of small-molecule drugs-pills you swallow. Biosimilars are highly similar versions of complex biologic drugs, like injections for cancer or autoimmune diseases. They’re not exact copies because biologics are made from living cells, not chemicals. But they’re proven to have the same clinical effect. Biosimilars are newer, more expensive to make, and less common-but they’re driving massive savings, especially in areas like rheumatoid arthritis and diabetes.

Why don’t all pharmacies automatically substitute generics?

Because state laws vary. Only 42 states let pharmacists substitute a generic unless the doctor says no. In the other eight, the prescription must specify "Dispense as Written" or the pharmacist needs explicit permission. Also, some insurers or pharmacy benefit managers (PBMs) have contracts that pay them more to push certain brands-even when generics exist. This is changing, but slowly.

Will generic drugs become even cheaper in the future?

Yes. More than 100 brand drugs are set to lose patent protection by 2027. That includes big sellers like Entresto and Opsumit. Each one will trigger a wave of generic competition, driving prices down. The FDA is approving more generics than ever-745 in 2024 alone. And with new laws targeting patent abuse, generic manufacturers will face fewer delays. Expect prices to keep falling, especially for common medications like statins, blood pressure pills, and diabetes drugs.

Comments

Man, I never realized generics were this big of a deal. I just take what my doctor gives me, but now I'm gonna start asking. $250 a year saved? That's like an extra vacation or at least a ton of jollof rice.

Also, Nigeria's got generic meds everywhere, and they're crazy cheap. No idea how they do it, but maybe we should copy that model.

The data presented is statistically significant and aligns with published findings from the Centers for Medicare & Medicaid Services. Generic drug utilization reduces overall pharmaceutical expenditures without compromising clinical outcomes. The FDA’s bioequivalence standards are rigorous and consistently upheld. Patients should be empowered to request generic alternatives when clinically appropriate.

It's interesting how the system rewards innovation in theory but punishes it in practice. The real innovation here is making medicine accessible. The fact that 90% of prescriptions are generics but only 12% of spending goes to them says more about corporate strategy than medical need.

I wonder if this model could be applied to other areas-like insulin or mental health meds. Maybe we're just not thinking big enough.

I switched my blood pressure med to generic last year and didn't even notice. My wallet noticed though. Saved me $40 a month. Why are people still paying full price? I don't get it.

Also, my pharmacist told me to check GoodRx-best tip ever.

Yeah right, generics are just as good. My cousin took the generic version of his antidepressant and started crying in the grocery store. Coincidence? I think not.

And don't even get me started on the FDA. They approve everything these days. My dog could pass a clinical trial if he had a PhD.

THIS IS A GAME CHANGER!!

Imagine if we stopped letting Big Pharma rob us blind. Generics are LEGAL, SAFE, and CHEAPER. Why are we still playing their game?

Ask your doctor. Ask your pharmacist. Tell your friends. This isn't just savings-it's justice.

SHARE THIS POST. NOW.

Okay so… like… the whole thing… with generics… it's not that they're bad… it's just that… the system… is… broken? Like, really broken? And also… I think… maybe… we should… fix it? But how? Like… who even… does that? I mean… I just want my pills to not cost a kidney.

Also… biosimilars? Is that like… a bio… thing? I'm confused.

And why do people keep saying 'patent thickets'? That sounds like a forest of lawyers.

Efficiency in pharmaceutical distribution is optimal when regulatory barriers to generic substitution are minimized. The 90/13 paradigm reflects market rationality, not failure. The primary distortion arises from patent manipulation, not pharmacological inferiority.

Policy intervention should target anticompetitive practices, not patient behavior.

I’ve seen too many people afraid to switch because they’re told ‘it’s different.’ But the science says otherwise. I work in a clinic-we’ve had patients panic over switching from brand to generic, only to realize their symptoms were stress, not the pill.

Education matters. Let’s stop scaring people into paying more.

OMG I JUST REALIZED I’VE BEEN PAYING FOR BRANDS FOR YEARS AND I DIDN’T EVEN KNOW I COULD’VE SAVED HUNDREDS!!

My mom’s on 4 meds and we’ve been paying $300 a month… I just checked GoodRx… the generics are $12 TOTAL. I’m gonna cry.

Also, my pharmacist didn’t even tell me this?? She’s fired. JK. But seriously… why isn’t this common knowledge??

Everyone needs to read this. Like, right now. I’m sending it to my whole family.

The pharmacoeconomic implications of generic substitution are well-documented in peer-reviewed literature. The marginal cost of production for small-molecule generics is negligible relative to R&D amortization of originator products. The persistent disparity in utilization versus expenditure reflects structural inefficiencies in PBM contracting and prescriber inertia.

Further research is warranted on formulary design incentives.

People who take generics are just lazy. If you can’t afford brand-name drugs, you shouldn’t be taking them at all. Why are we subsidizing people who can’t manage their health? The system isn’t broken-it’s just exposing who’s irresponsible.

And don’t get me started on the FDA. They approve everything. Even the generic version of my neighbor’s cat’s thyroid meds. What is this world coming to?

Just switched my cholesterol med to generic last month-saved $78! And my doctor didn’t even mention it! Why don’t they tell us this stuff?

Also, my pharmacist said some generics are made in the same factory as the brand. Same pill. Different label. I feel like I’ve been scammed for years.

PS: If your doctor says ‘this one’s different,’ ask them if they get kickbacks. Just sayin’.

Thank you for sharing this comprehensive overview. The data on biosimilars is particularly compelling. I’ve encountered patients who fear switching due to misinformation. This kind of clear, evidence-based communication is essential to improving adherence and reducing financial toxicity.

May I suggest distributing this to primary care networks and community pharmacies? It could be a powerful educational tool.

THIS IS A SCAM. A BIG, FAT, PHARMA SCAM.

They make billions off brand drugs. Then they sit on patents like dragons hoarding gold. Meanwhile, people skip doses because they can’t afford the $100 pill.

Generics are the only reason I’m still alive. And now they want to make it harder to get them?

I’m not just mad-I’m furious. And I’m telling everyone I know.

While anecdotal reports of differential efficacy exist, they are statistically negligible and often confounded by placebo effects or changes in inactive ingredients. The FDA’s bioequivalence thresholds are set at 80–125% for AUC and Cmax, ensuring therapeutic equivalence. Patient concerns should be addressed with data, not dismissal.